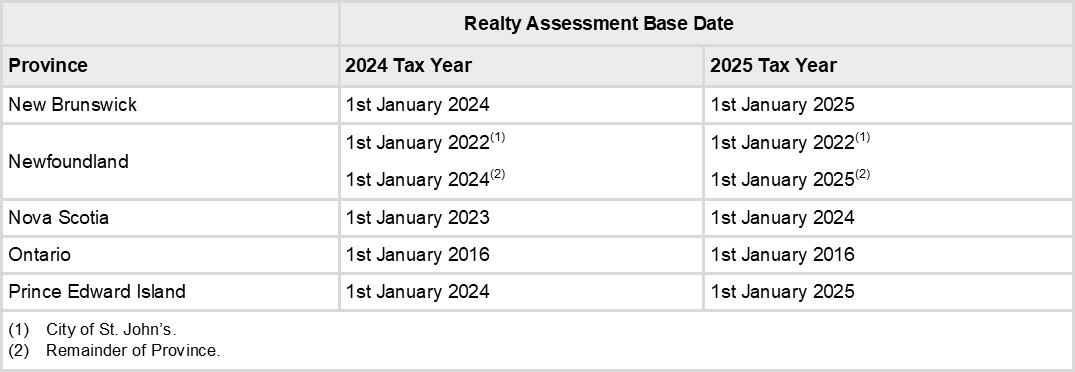

The various provincial Assessment Acts decree that your property tax assessment be based on the Market Value of your property on a specified “base date”. The Market Value is the price you would realize if you sold the property on the open market. If your property is located in Ontario, New Brunswick, Prince Edward Island, Nova Scotia or Newfoundland, the relevant base dates are as follows:

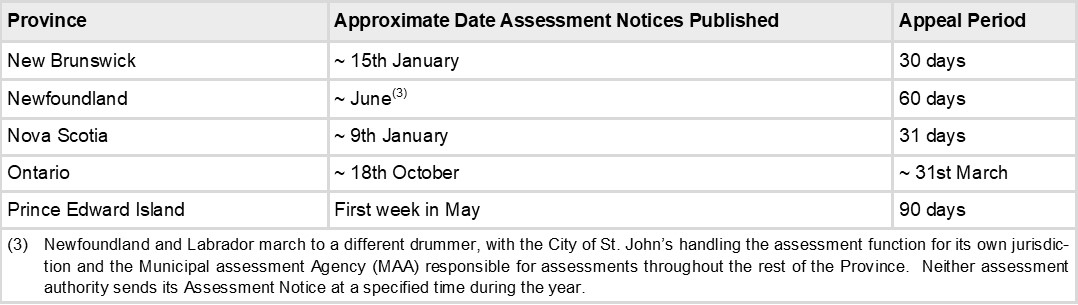

Assessment Authorities such as MPAC (Ontario), Service New Brunswick, Taxation PEI, PVSC (Nova Scotia), MAA (Newfoundland) usually assess properties below their Market Value to discourage appeals and make life easier for themselves. Unfortunately there is nothing uniform about the degree of under-assessment so nearly identical properties can have very different property tax assessments. Fortunately most Assessment Acts anticipate this type of trick and mandate some type of “uniform” property assessment provision legislating that like properties bear similar property assessments. So it is very usual for a property to be assessed at less than its Market Value but still be over-assessed and thus a good candidate for a successful assessment appeal. The Assessment Appeal Periods are often short:

The Appeal Periods start when the assessment notices are published and vary by province:

Because of our excellent track record in Assessment Appeal Court, over 90% of our property tax appeals are now settled by negotiation with the various Assessment Departments. Nevertheless it is sometimes still necessary to proceed to court where points of principle are involved or the Assessor is obdurate. Potentially therefore we employ the following three stage process:

Stage 1 (Assessment Audit) – We review the property assessment and compare it with other property assessments and the costing manuals employed by the Assessor. We report back to our client by letter with a thorough analysis of the assessment calculations, detailing our estimate of the correct property assessment, the potential tax savings, our recommended course of action, the probability of success and the associatedcost.

Our recommended course of action will usually be, (1) negotiation with the Assessor, or (2) abandonment of the appeal. We will not undertake frivolous appeals. We achieve tax savings with virtually every property tax assessment appeal we undertake because Assessors recognize that we do not get involved unless there are genuine grounds for questioning the property assessment.

Stage 2 (Negotiation) – If the client wishes us to conduct the property tax appeal we prepare a position paper and open negotiations with the Assessor. We are able to conclude over 90% of all property tax appeals by negotiation. However if we are unable to reach a satisfactory settlement we report back to our client by letter detailing our recommended course of action, the probability of its success and the associated cost of proceeding to the next stage of the property tax appeal.

Our recommended course of action will usually be, (1) proceed to the Assessment Appeal Board, or (2) abandonment of the assessment appeal.

Stage 3 (Appeal Board) – We appear on the client’s behalf to present the case before the Assessment Appeal Board. Legal counsel is not required unless the appearance is before the Ontario Assessment Review Board.

The decision whether to proceed to each stage rests entirely with our client: the potential tax savings and the probability of achieving them have to be weighed against the cost involved.

We are happy to provide a Price Quote on any of the above Property Tax products.

Our early experience of negotiating with reluctant and arrogant property assessment authorities in the hard scrabble world of Atlantic Canada, fighting them in assessment appeal court where necessary, molded our approach to assessment appeals throughout Canada. We developed a seven year training and education program to create a Property Tax Team second to none, a data centric focus, and a culture of fighting for the last dollar of property tax savings. Property Tax Success Stories graphically demonstrates how that investment has paid off for clients seeking to minimize their property tax load:

Click here for relevant Property Tax Case Law.